By MELINDA J. OVERSTREET

for Glasgow News 1

A 2-1 majority of the Glasgow Common Council approved the first of two required readings Monday of an ordinance reducing the city’s real property and personal property tax rates for this year.

Prior to the special-called meeting, a public hearing took place regarding the proposed rates, but, as usual, no one from the community chose to voice their opinion on the matter.

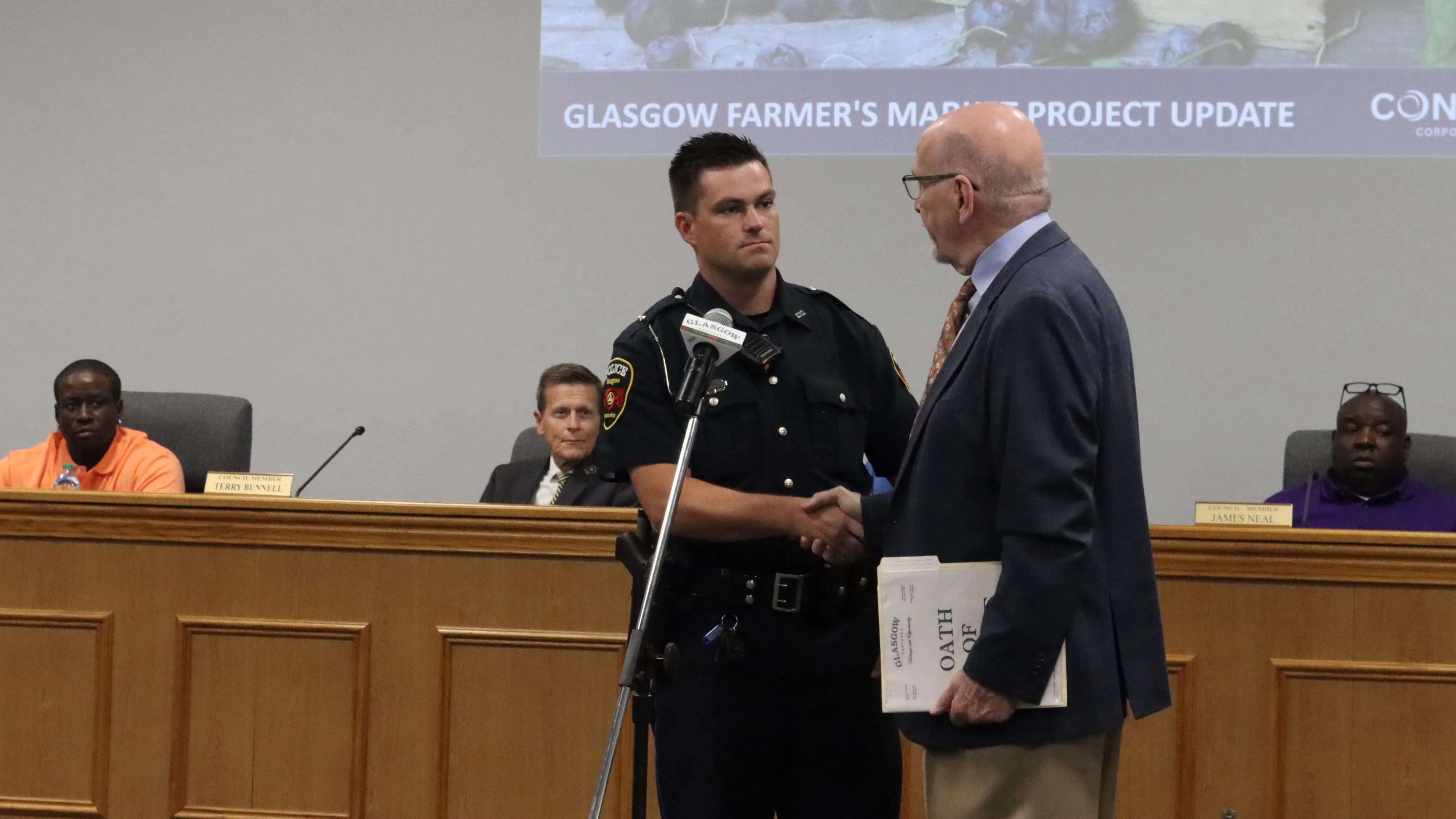

The tax-rate ordinance was actually the last thing on the agenda before adjournment, so before they got to that, the council saw Dawson Wooten get sworn in as a new police officer and heard three presentations, information from which are in a separate GN1 news report. The presentations contained updates on construction of the farmers market construction and development of the former Johnson property and the report on the audit for the 2023-24 fiscal year.

Additionally, three other action items were approved unanimously. They were:

– a municipal order to appoint Patrick Slater to fulfill the unexpired term of Sam Chambers on the Glasgow Municipal Airport’s board of directors;

– a resolution authorizing a grant application to the Kentucky Department for Environmental Protection for the city’s litter abatement program; and

– a resolution declaring certain Glasgow Fire Department property – a 1999 aerial firetruck and a zero-turn mower – as surplus and authorizing disposition.

The current rate for both real property and personal property is 0.169, or 16.9 cents per $100 of assessed value of the property, and the proposed rate is 0.165, or 16.5 cents, per $100 of assessed property value.

The compensating rate – the one that would be expected to produce roughly the same or close to the amount of revenue as the prior year, as calculated by the Kentucky Department for Local Government and provided to the city, would be 0.160, or 16 cents, per $100 of assessed property value.

According to information provided at a special meeting of the council’s finance committee in late August, the total revenue received from the 2024 tax bills, as of April 2025, was $2,031,528. If the city went with the compensating rate, its revenue would be roughly $18,460 higher than what was collected last year, but it still would be approximately $100,012 less than the $2.15 million the budget calls for, because property assessments weren’t as high as anticipated.

The proposed rate is a compromise that would still reduce the rate for property owners, but this rate’s anticipated revenue of $2,114,050 would be roughly $82,522 more than from the previous year. It would still be a smaller amount than what is budgeted, but the gap wouldn’t be as wide.

Once the city attorney had read the proposed ordinance aloud, Councilman Randy Wilkinson, who had attended that finance committee meeting as a guest, kicked off the discussion by saying he would be voting against it, because he thought they should be using the compensating rate.

He said he understands that the city is lowering the rate, “technically,” before he claimed that, “In reality your tax bill’s going to go up because of your property valuation, which is great – everybody’s property is increased, and I’m all for that, that your property is more value, but I think we should be able to operate with what we operated last year.”

The tax rate is multiplied by the assessed value of a property, so if the value goes up but the rate were the same, for example, the tax bill would rise correspondingly with the value. The same would apply to a decrease in property value. If a property’s value was not reassessed this year by the property valuation administrator’s staff and/or the value did not change for any other reason, and the rate were the same, the tax bill would not rise. So, a tax-bill increase is not a certainty.

Wilkinson said the finance committee has things in good hands and he hears positive things about the budget, though he said he didn’t understand all of it.

He pointed out that the county government and city and county school districts also levy property taxes, so with everything combined, it can be hard on property owners.

Councilman Terry Bunnell, who chairs the finance committee, which agreed to recommend the rates proposed to the full council, recapped some of the figures about how much revenue was expected compared with how much was budgeted.

“However, when we look at running the city and all the other costs involved, that we’ve had increases on from insurance to fuel to supplies and all across the board, then I think the 0.165 is a good compromise for us. It’s going to be fair to everybody,” Bunnell said.

He said they can’t drop the tax rate too much and risk starting to run behind with deficit budgets, “and so everybody needs to be prudent in the management of what we’re doing with this.”

Bunnell said taking the compensating rate would be expected to increase the city’s revenue by roughly $18,000, but he believes the increases in expenses are more than that.

He pointed out that some people may see an increase due to higher property values, but some could actually see a decrease.

“We in city council don’t control the PVA. We don’t control the assessments. We don’t control what you build your house for, what you buy your house for,” Bunnell said. “All that we’re trying to do is use the ad valorem tax as a way to help us continue to run city government.”

He said he thought the proposed rate is fair, prudent and expedient, and he would encourage everyone to vote for it. He added that they need to continue to look at the budget and make sure they’re going in the right direction with it.

Councilman Joe Trigg said to Bunnell that when they were discussing it earlier, he thought perhaps they should leave the rate the same as last year’s, 0.169, and he echoed what Wilkinson said about other entities also having their own rates.

His concern was whether they would have enough to run the city with the lower rate, and if they left it the same, “would that not meet our needs?”

Bunnell said again that this is a compromise that allows them to be significantly closer to the budgeted amount yet provide a rate reduction to the property owners.

Ultimately, Trigg said that if Bunnell and the committee were comfortable this proposed rate would be enough, he thought they should press on with it.

Bunnell said neither he nor anyone else could never guarantee such a thing, because there are too many unknown variables out there.

“Our role as the finance committee [is] to look to see if it’s fairly representative for a city this size …, No. 2, how does it fit in the overall revenue scheme that we’ve got, and then say to the citizens of Glasgow, I mean, this is fair. This is where we’re at,” he said.

After he spoke for a few more minutes, no one else had comments or questions.

After a voice vote, it was unclear how many votes there were for which position, and a roll-call vote was taken. Wilkinson, along with council members Elizabeth Shoemaker and Marna Kirkpatrick, voted in opposition of the ordinance. Bunnell and Trigg plus council members Freddie Norris, Chasity Lowery, James “Happy” Neal and Tommy Burris voted in favor.

The 2024 property tax rate for motor vehicles and watercraft was 0.270, or 27 cents, per $100 of assessed value, and it generated approximately $330,074 in revenue.

The budgeted amount from these types of property for the current fiscal year is $345,000, and continuing with this rate in 2025 as proposed and discussed by the finance committee is expected to bring in approximately $337,990.

Glasgow News 1 asked the mayor after the meeting about whether a vote was needed for this rate, even though it would be staying the same, and he was under the impression it was included in with the ordinance, but there was no such wording in the ordinance read during the meeting.

Comments